Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. It also does not guarantee that this information is of a timely nature.

Nvda price action after earnings report free#

FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. You should do your own thorough research before making any investment decisions. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Once Nvidia stock breaks above $311, there is a volume gap that means record highs should soon follow.

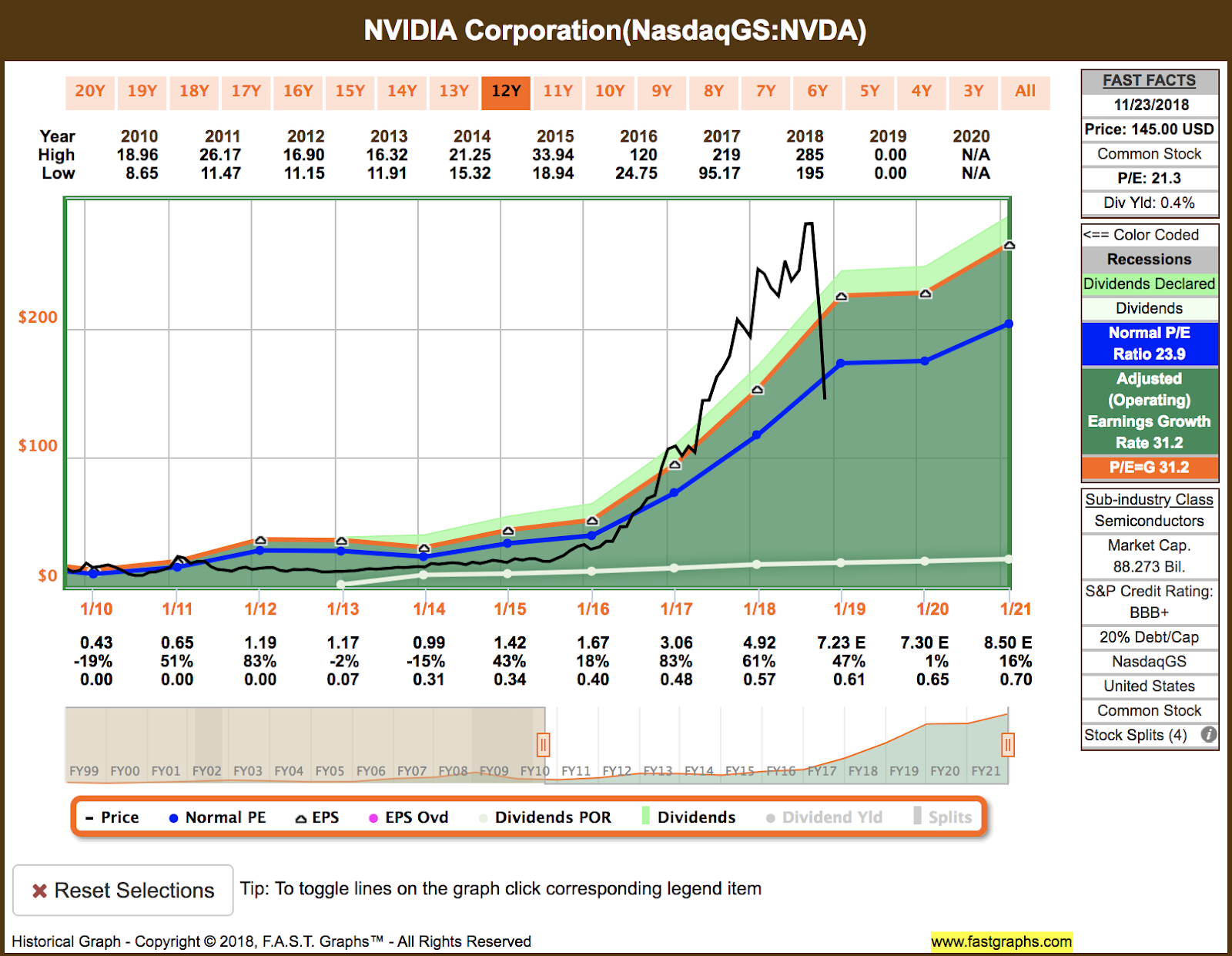

The 15-minute chart shows the strong level of volume from the recent sideways move. We would, therefore, like to see the stock push record highs ideally before this week is out to confirm the fundamentals. With earnings and outlook strong, there is no doubting that. As demonstrated above, the stock has outperformed even others in the hot semiconductor sector, and with regulatory concerns growing over the ARM purchase maybe things begin to slow. So far so good with the stock up 6% in the premarket.Īny failure to push higher and we fell it will mark the start of a gradual retracement back to $230. Semis are hot, and earnings are strong, so the reaction is key. Otherwise, we potentially put in a bearish double top or a bearish lower high. The key question here is whether this earnings report can push the stock to fresh all-time highs. The UK is to investigate the matter fully as it has concerns over national security. Some dampening of the enthusiasm was the fact that The Financial Times reported that US regulators have also raised concerns over Nvidia's potential purchase of UK chipmaker ARM. Nvidia shares rose 3% on the release and are currently 6% higher in Thursday's premarket.Ī host of rating changes have been released as of Thursday morning from Piper Sandler, Bernstein, Jefferies and JPMorgan. Q4 revenue is now expected to be in the range of $7.4 billion versus prior estimates for $6.86 billion. The company also issued guidance for Q4 that was higher than analyst expectations. Revenue was $7.1 billion versus the $6.83 billion estimate. Earnings per share came in at $1.17 versus the $1.10 estimate. Nvidia reported earnings after the close on Wednesday. It includes Nvidia, Texas Instruments, Taiwan Semiconductor, Broadcom, Qualcomm, Intel, AMD, etc. The Philadelphia Semiconductor Index is a market-cap-weighted index of the 30 largest companies involved in the semiconductor industry. Nvidia has outperformed the sector as we can see below versus the benchmark Philadelphia Semiconductor Index (SOX). Chip stocks have been strong this year, so the reaction to a further strong earnings report will be key to see if this strength can be maintained. Nvidia shares actually fell on the regular session, closing down over 3% at $292.61. Nvidia looks set to open strongly on Thursday as the chip manufacturer reported a strong set of earnings after the close last night.

Nvidia still running into problems with the proposed ARM deal.Nvidia surges after earnings report with top and bottom line beats.

0 kommentar(er)

0 kommentar(er)